Best Buy (BBY) delivered impressive holiday quarter earnings that beat analyst expectations, giving the stock a 5% boost so far Thursday. It’s on track for its best performance since November 2022.

The company’s dwindling sales have been a burden for some time, but it appears as if things are finally trending back in the right direction. While analysts were forecasting a 5.3% dip in comparable sales, the figure was only 4.8%.

Best Buy is still struggling with home theater, appliances, mobile phones, and tablets sales, which continue to hold back growth. However, these segments were offset by an uptick in gaming sales.

The company also saw international sales grow by 2.7% to $1.24 billion. While $60 million of this improvement is attributed to an extra week in the quarter, it’s promising nonetheless.

CEO Corie Barry says that the consumer electronic sales climate is still experiencing pressure, but a steadfast commitment to operational execution allowed the company to overcome this challenge.

In fact, the company managed to perform in line with its original guidance range from an annual profitability standpoint despite underperforming in the sales department. Non-GAAP operating income came in at 5% of sales, up from 4.8% last year. Its domestic gross profit rate specifically skyrocketed to 20.4% of sales.

Much of the profitability improvements can be attributed to better performance in membership offerings. This segment picked up the slack as product margin rates rose.

Best Buy is expecting to deliver between $41.3 billion to $42.6 billion, while analysts are expecting $42.2 billion. The company’s earnings guidance of $5.75 to $6.20 is aligned with the $6.14 consensus at its high end.

But, the big takeaway is that the company sees potential to deliver flat sales growth for the year – finally putting an end to dwindling sales figures.

So, as the stock has climbed nearly 14% in the past month, is it time to buy BBY? You’re going to want to see the 3 things we found through the VectorVest stock analysis software below.

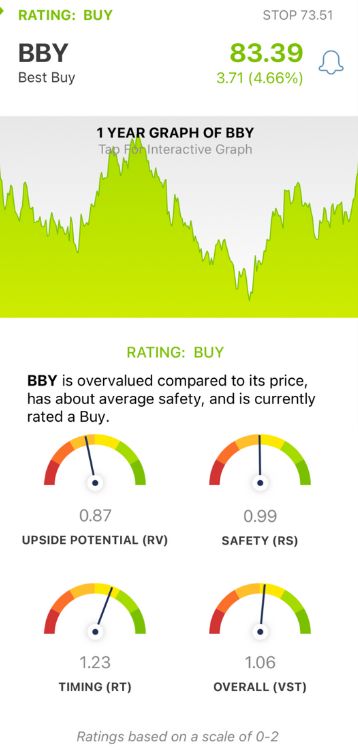

BBY Has Fair Upside Potential and Safety With Good Timing, Earning the Stock a BUY

VectorVest simplifies your trading strategy by giving you clear, actionable insights in just 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. Ratings above the average indicate performance in a given category and vice versa.

It gets even better, though. You’re given a buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for BBY, here’s what we’ve uncovered:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This offers much better insight than the typical comparison of price to value alone. BBY has a fair RV rating of 0.87.

- Fair Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. BBY has a fair RS rating of 0.99.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.23 is good for BBY, reflecting its recent performance.

The overall VST rating of 1.06 is fair for BBY, and it’s enough to earn the stock a BUY recommendation in the VectorVest system.

Learn more about this opportunity before you do anything else by getting a free stock analysis today - you’re not going to want to miss this chance!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. BBY earnings suggest that the company is moving in the right direction, and the stock is on track for its best performance in well over a year. It has fair upside potential and safety with good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment