The world’s second-largest brewer is having a hard time getting customers on board with price increases. Heineken (HEINY) reported a drop off in the volume of beer sold for the most recent quarter, sending shares 5% lower this Wednesday morning.

After increasing prices on average 10.2% around the world, the Amsterdam-based company only managed to sell 242.6 million hectoliters (mhl) – a 4.7% decrease year over year.

According to CEO Dolf van den Brink, though, this was an absolute necessity to combat high input and energy costs. Other factors contributing to the drop in volume include volatile macro-economic conditions in certain demographics.

Those key demographics included the likes of Nigeria and Vietnam, which contributed to as much as 60% of volume drop last year. Both these countries are experiencing an economic slowdown.

Vietnam specifically cracked down on drunk driving with a new zero-tolerance policy, which further discouraged customers from purchasing beer.

Europe saw its own slump with a 5.4% decrease year over year.

The price hikes were intended to bolster profitability – but the move may have made matters worse, as net profit fell 14.1% year over year to just €2.3 billion. Analysts were expecting at least €2.6 billion.

So, can Heineken turn things around in the new year? The goal for 2024 is to boost volume and in turn, increase operating profits. The expectation is a single-digit increase in margin.

However, the rising costs that plagued the company in 2023 haven’t gone anywhere. In fact, Heineken is expecting costs to rise by a low-single-digit percentage. One big area of concern is the steep tax rate increase in the company’s second-largest market: Brazil.

Still, the company is confident its €500 million cost savings plan will offset higher input costs, devaluation of currency, wage inflation, and other challenges.

But as HEINY has fallen nearly 9% in the last week now, should investors be concerned? We’ve dug deeper into the VectorVest stocks software and found 3 things you need to see today…

HEINY Still Has Fair Upside Potential, Safety, and Timing

VectorVest is a proprietary stock rating system that has outperformed the S&P 500 index by 10x over the past 20 years and counting.

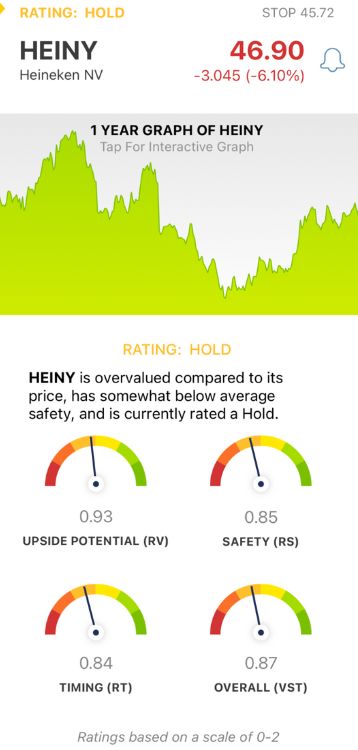

It’s all based on 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each rating sits on its own scale of 0.00-2.00 with 1.00 being the average. This makes for quick and easy interpretation.

Or, you can simply follow the clear buy, sell, or hold recommendation the system issues based on the overall VST rating for any given stock at any given time. Here’s what we’ve uncovered for HEINY:

- Fair Upside Potential: The RV rating is a comparison of a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It offers much better insight than a simple comparison of price to value alone. HEINY has a fair RV rating of 0.93.

- Fair Safety: The RS rating is a risk indicator. It’s calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. HEINY has a fair RS rating of 0.85

- Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of a stock’s price movement day over day, week over week, quarter over quarter, and year over year. HEINY has a poor RT rating of 0.84, as today’s drop-off adds to what has been a tough few weeks for investors.

In the end, though, the overall VST rating for HEINY is still deemed fair at 0.87. The stock is rated a HOLD in the VectorVest system. But, we encourage you to learn more through a free stock analysis yourself today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. HEINY is seeing volume drop after raising prices around the world. The stock may have poor timing after falling an additional 5% today, but its upside potential and safety are fair.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment