Ford Motor (F) gained 6% Wednesday before settling around 3% after delivering Q4 earnings that surpassed expectations. The company also announced it would be issuing a special dividend.

The automaker grew revenue in Q4 by 4% to $46 billion, outpacing analyst expectations – but the earnings beat stole the show. Ford reported 29 cents per share compared to the 14 cents analysts were expecting. However, this was a big step back from 2022 in which the company delivered EPS of 51 cents.

This could be attributed to challenges in the company’s EV department. Ford noted that customers are slower to adopt EVs than anticipated. Pressure on prices is also creating problems from a profitability standpoint.

This is leading to steeper and steeper losses in the electric vehicle business. Ford is projecting a loss between $5 billion and $5.5 billion for the segment in the quarter ahead. The good news? CFO John Lawler says the company is unphased and expects the automaker’s next generation of EVs to attain profitability within the first year.

For the fiscal year ahead, Ford is forecasting adjusted earnings of $10 billion to $12 billion before interest and taxes. The top end of that range got a lift since the company’s last update in November. With the UAW strike no longer limiting growth, the company should be able to hit its stride.

On top of all this, Ford is paying out a first-quarter dividend of 15 cents alongside a special dividend of 18 cents. The company is returning surplus cash to shareholders at a rate of 40% to 50%. This figure could be as high as $7 billion in 2024, suggesting shareholders would earn back as much as $3.5 billion.

While the stock has climbed incrementally today, F is up 21% over the past few months. But only 36% of analysts call it a buy right now. We’ve taken a look through the VectorVest stock analysis software and see 2 specific reasons to consider buying F today.

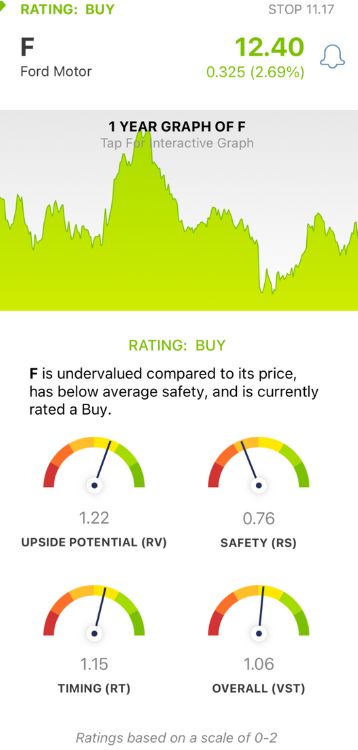

F May Have Poor Safety, But the Stock Has Good Upside Potential and Timing

VectorVest is a proprietary stock rating system that saves you time and stress while empowering you to win more trades. It’s all based on 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these sits on its own scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy, but it gets even easier. The system offers a clear buy, sell, or hold recommendation for any given stock at any given time. As for F, here’s what we found:

- Good Upside Potential: The RV rating is a comparison of a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This indicator offers much better insight than the typical comparison of price to value alone. F has a good RV rating of 1.22 right now.

- Poor Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. F has a poor RS rating of 0.76 right now.

- Good Timing: The RT rating speaks to a stock’s price trend. It’s based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. As for F, the stock has a good RT rating of 1.15.

The overall VST rating of 1.06 is good for F - and it’s enough to earn the stock a BUY recommendation in the VectorVest system. Learn more about this situation and capitalize through a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. F is up a few percentage points after beating the top and bottom line for Q4 earnings while announcing a special dividend for shareholders. The stock has poor safety, but good upside potential and timing are enough to earn it a buy.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment