Shares of Netflix (NFLX) are up more than after the streaming company delivered solid 4th quarter earnings, optimistic guidance for the year ahead, and perhaps most importantly, a highly anticipated deal with TKO – the parent company of WWE.

As cable television continues to fizzle out, streaming services are bringing live sports programming into their offerings. Many have been wondering when Netflix would get in on the action as Peacock, Amazon Prime, Disney, Hulu, and others have already inked partnerships with leagues.

In a very unique move, Netflix has entered the live sports streaming cage through a 10-year deal starting in 2025. The $5 billion partnership will include WWE Monday Night Raw, which airs weekly. With 11 million fans in the US alone and 1 billion viewers worldwide, this move will continue to accelerate Netflix’s growth goals.

Speaking of growth, the company has been on an upward trajectory since working to put an end to password sharing. This continued in the 4th quarter with a 12.5% growth in sales, up to $8.83 billion. This was the company’s fastest year-over-year growth in 3 years.

While earnings of $2.11 per share came in short of the $2.22 Wall Street was looking for, the market seemed to focus primarily on the good news – and there is certainly a lot of reason to be excited if you’re invested in this stock.

Looking ahead to the first quarter of the year Netflix is forecasting a profit of $4.49 while analysts are expecting just $4.14. This is accompanied by a projected revenue growth of 13% for the quarter – outpacing last quarter’s impressive performance. Operating margins are expected to climb up to 24%.

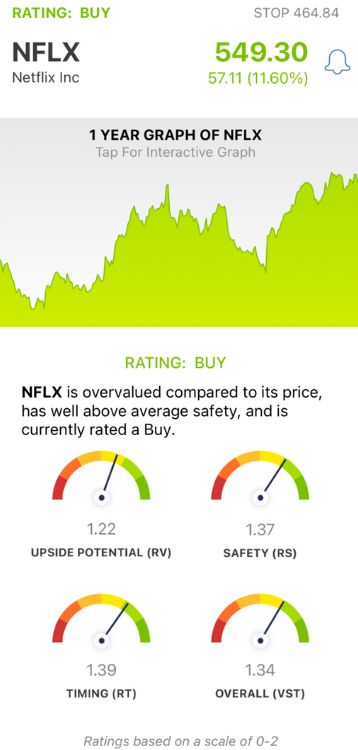

NFLX is up 12% on this news so far in Wednesday’s trading session and is now up nearly 32% in the past 3 months. If you don’t already own this stock, should you buy it today? We’ve assessed the current opportunity through the VectorVest stock analysis software and found 3 things you should see…

NFLX Has Good Upside Potential With Very Good Safety and Timing

VectorVest simplifies your trading strategy by boiling down all the information you need to make clear, calculated decisions into 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00, with 1.00 being the average.

Interpreting the ratings and using them to execute trades is quick and easy - but it gets even better. You’re even given a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for NFLX, here’s what we’ve uncovered::

- Good Upside Potential: The RV rating is a comparison of a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. The indicator offers much more valuable insights than a simple comparison of price to value alone. NFLX has a good RV rating of 1.22 right now.

- Very Good Safety: The RS rating is a risk indicator that comes from a detailed analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. NFLX has a very good RS rating of 1.37 right now.

- Very good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year to paint the full picture for investors. As you can see from the stock’s performance over the past few months, NFLX has a very good RT rating of 1.39.

All this leads to a very good overall VST rating of 1.34 alongside a BUY recommendation for NFLX. Learn more about the current opportunity and how you can capitalize with a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. NFLX is climbing on news of its impressive Q4 performance, excitement over the current quarter’s guidance, and a landmark deal to bring live WWE programming to the streaming service. The stock has good upside potential with very good safety and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment