After leading 2023 as the S&P 500 index’s best performer, Nvidia (NVDA) is picking up where it left off to start the new year. The stock has climbed nearly 14% in the past week and is up more than 2% in Wednesday morning’s trading session.

This recent breakout puts its market cap at $1.3 trillion, just $250 billion off of Amazon’s valuation. As Nvidia continues to rally towards a record high, investors are hopeful it can take the crown from Bezo’s e-commerce platform as the world’s 4th most valuable company.

But what is Nvidia doing that has led to this rally? It’s not necessarily the company itself, although they are certainly doing their part to capitalize on the opportunity. Rather, it’s the burgeoning chip market that shows no signs of slowing down.

Nvidia saw revenue skyrocket 206% in the third quarter and is forecasting even more growth in the 4th quarter, with a projection of 232% growth. The company’s growth was stifled last year after regulations on chip exports to China took the wind out of its sails.

Another reason investors keep driving this stock’s value up is its relentless pursuit of innovation. Just this week Nvidia teased 3 new desktop graphics chips designed for enhanced AI usage. The chipmaker is still all-in on the AI boom, with both its CFO and CEO saying they see AI-related product demand continuing to grow into 2025.

While it is generally accepted that NVDA will not repeat its 2023 performance, 93% of analysts rate it a “buy” – and its average price target is $650, implying a nearly 20% upside from today’s price of $540.

We’ve taken a deeper look at this current opportunity and uncovered 3 more reasons to buy NVDA through the VectorVest stock analysis software. You’re not going to want to miss out on this opportunity…

NVDA Has Excellent Upside Potential, Safety, and Timing Right Now

VectorVest has outperformed the S&P 500 index by 10x over the past two decades and counting, all while empowering investors to save time and stress through a simplified trading strategy.

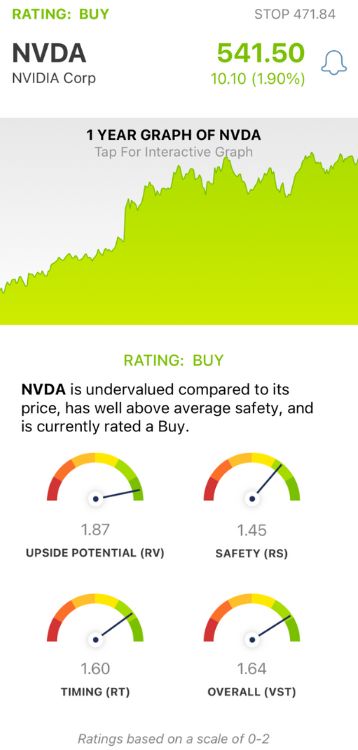

The proprietary stock-rating system is comprised of 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation.

It gets even better, though. The system issues a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for NVDA, here’s what we’ve discovered:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year projection) to AAA corporate bond rates and risk. It offers much better insight than the typical comparison of price to value alone. NVDA has an excellent RV rating of 1.87 right now. While some say it's too expensive at its current price, VectorVest deems it undervalued - with a current value as high as $678!

- Excellent Safety: The RS rating is a risk indicator. It’s derived from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. As for NVDA, the stock has an excellent RS rating of 1.45.

- Excellent Timing: As you can see from NVDA’s recent performance, it has excellent timing as well - and the RT rating of 1.60 reflects this. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.64 is excellent, and this stock is rated a BUY in the VectorVest system. But, we encourage you to learn more about this current opportunity (including where to set your stop loss) through a free stock analysis today before pulling the trigger!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. NVDA is already up more than 14% to start the New Year, as the company’s performance shows no signs of slowing down in the short or long term. The stock has excellent upside potential, safety, and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment