Shares of Walgreens (WBA) are down more than 6% in Thursday’s trading session after the drugstore retailer reported its fiscal first-quarter earnings. Earnings per share of 66 cents beat the consensus of 61 cents, while revenue of $36.71 billion topped the $34.86 billion expected.

The company did report a net loss for the quarter of $67 million, or 8 cents a share. This is actually good news as this time last year the company posted a much wider loss of $3.7 billion, or $4.31 a share. This came after a net loss last quarter of $278 million.

But, the real takeaway from the earnings call wasn’t revenue or profits – it was dividend cuts that left a sour taste in investor’s mouths. The company announced it would be slashing the dividend nearly in half, taking it down to 25 cents per share from 48 cents per share.

CEO Tim Wentworth did his best to quell investor outrage, saying this is a necessary strategic move to strengthen its long-term balance sheet and cash position. While it may be the right move, it’s not what investors wanted to hear from a CEO who just took the helm this quarter.

Walgreens was previously the highest-paying dividend stock across the entire Dow, with a yield of more than 7%. Today, though, its yield is just 3.9%. This was the first time the company had to cut its dividend in more than 50 years.

Even though the stock’s performance today would suggest otherwise, Wentworth says that most investors are excited about this move and what it means for the company in the long run.

Say what you will about the dividend cut, but Wentworth is coming into a tough position as the company has struggled since the easing of COVID-19 demand for vaccines and tests. The stock fell more than 30% last year as a result of this coupled with other challenges.

That being said, you may be struggling with what this news means for you as an investor. With a lower dividend, is it still worth holding onto WBA or should you sell? Is there any reason for new investors to buy the stock after cutting its dividend in half?

We’ve taken a look through the VectorVest stock analyzer and found 3 things you should know before you do anything else.

WBA May Have Poor Safety, But the Stock’s Upside Potential and Timing Are Fair Right Now

VectorVest is a proprietary stock rating system comprised of 3 simple ratings that save you time and stress while empowering you to win more trades. It’s outperformed the S&P 500 index by 10x over the last two decades and counting.

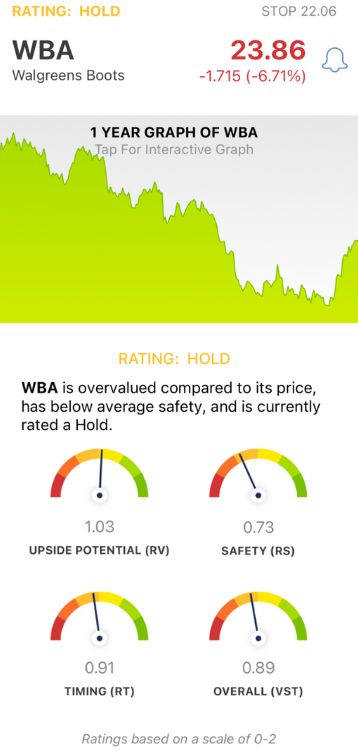

These ratings are relative value (RV), relative safety (RS), and relative timing (RT). Each rating sits on an easy-to-interpret scale of 0.00-2.00 with 1.00 being the average. Ratings above the average indicate overperformance in a given category and vice versa.

But, it gets even easier. VectorVest offers a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for WBA, here’s what we’ve uncovered:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted three years out) to AAA corporate bond rates and risk. It’s a much better indicator than a simple comparison of price to value alone. As for WBA, the RV rating of 1.03 is fair.

- Poor Safety: The RS rating is a risk indicator computed through a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, and price volatility. WBA has a poor RS rating of 0.73, a reflection of the company’s struggles over the past few years.

- Fair Timing: Despite falling in today’s trading session, WBA still has a fair RT rating of 0.91 - albeit below the average. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.89 is considered fair despite being a bit below the average. Nevertheless, VectorVest has placed a HOLD recommendation on this stock. You should take advantage of a free stock analysis today to learn more though, and transform your trading strategy for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. WBA is down more than 6% today after beating earnings, but slashing the dividend in half. The stock has poor safety, but it also has fair upside potential and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment