Apple (AAPL) delivered quarterly earnings Thursday evening and narrowly surpassed analyst expectations. But, the lack of guidance issued for the fiscal first quarter of the year (December quarter) left analysts and investors alike perplexed and assuming the worst – shares are down 2% as a result.

The company’s fiscal fourth quarter saw a slight step backward in revenue, with $89.5 billion just beating out the forecasted $89.3 billion by Wall Street. This was a 1% drop year over year. It also represented the fourth quarter in a row where Apple’s revenue fell year over year.

Apple posted an EPS of $1.46/share which surpassed the FactSet consensus of $1.39/share, while a gross margin of 45.2% barely beat the guidance range of 44%-45%.

iPhone sales were one of the few bright spots for the quarter, as the segment showed a 3% growth to $43.8 billion. This was a record performance for phone sales in the company.

But, what really took the market by surprise was revenue attributed to services – the $22.3 billion figure was a 16% jump. This was also a milestone performance for Apple.

The segments that suffered the most included wearable, home, and accessories (down 3%), Mac revenue (down 34%), and iPad revenue (down 10%). Apple struggled in Asian and European markets, while America remained mostly flat.

The full-year results weren’t all that positive either, with revenue of $383.3 billion representing a 3% drop. EPS of $6.13/share was a very slight improvement of 2 cents. But, looking ahead to the future is where the real concern comes in.

Wall Street was forecasting revenue of $122.98 billion for the current quarter, and Apple declined to issue a formal guidance. CFO Luca Maestri merely states that the revenue would be similar to last year. Last year the company delivered just $117.2 billion – setting the stage for a miss already.

While AAPL had gained 5% leading into Thursday’s earnings report, the cautious outlook and lackluster performance sent shares back the other way. They’re now down nearly 6% over the past few months. So, what does this mean for investors?

We’ve taken a look at AAPL through the VectorVest stock analysis software and uncovered 3 things you need to see before you do anything else with this stock…

AAPL Has Very Good Safety and Fair Timing, But Poor Upside Potential Holding it Back

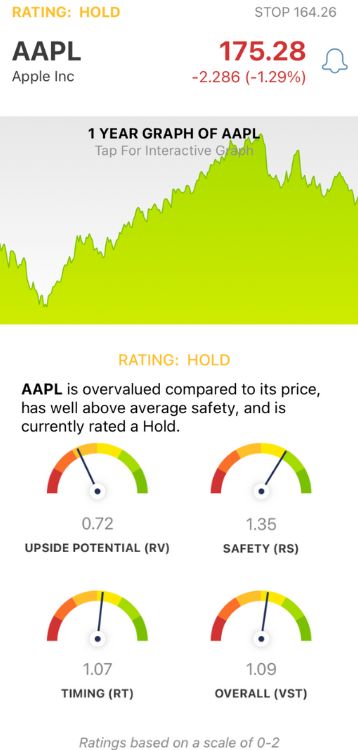

VectorVest simplifies your trading strategy through a proprietary stock-rating system. You’re given clear, actionable insights in just 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy. You’re also given a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for AAPL, here’s what we found:

- Poor Upside Potential:The RV rating compares a stock’s long-term price appreciation potential (forecasted three years out) to AAA corporate bond rates and risk. AAPL has a poor RV rating of 0.72, which is coupled with the fact that it’s overvalued right now. Current value is just $82.65.

- Very Good Safety:The RS rating is an indicator of risk. It’s derived through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, price volatility, sales volume, and other risk factors. AAPL has a very good RS rating of 1.35.

- Fair Timing: Even though AAPL fell in Friday morning trading, the stock was rallying in the right direction leading into today - and still has an above-average RT rating of 1.08, which is considered just fair. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.10 is good - but not quite enough to earn the stock a BUY rating. AAPL is rated a HOLD in the VectorVest system as of now.

Stay up to date and learn more about how the VectorVest system can transform the way you trade for the better with a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. AAPL underwhelmed with its quarterly earnings and lack of guidance, sending shares down 2% in Friday trading. The stock has very good safety and fair timing, but poor upside potential is holding it back right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment