United Airlines (UAL) dropped more than 8% in Wednesday morning’s trading session after the company issued a grave profit warning along with its 3rd quarter earnings results.

Adjusted earnings per share came in at $3.65 compared to the $3.35 analysts were looking for. Revenue narrowly outperformed the estimate at $14.48 billion compared to $14.44 billion. This was an improvement year over year from $12.88 billion previously.

While the airliner did manage to beat expectations for the third quarter, the road ahead looks rocky as a result of the ongoing feud between Israel and Hamas. In fact, the company expects a direct correlation between the length of the war and the degree to which profits will suffer.

There are two issues at play for United. First and foremost, crude oil prices are up, stoking existing concerns over rising fuel costs that will eat into profitability. US airports are reporting a 25% surge in prices since the beginning of summer.

But, the most pressing issue is flight suspensions into Tel Aviv amid the turmoil in the Middle East. While this will affect all airliners, United has the highest exposure to Tel Aviv – which is about 1.8% of its total. The company had flights to Israel from DC, Newark, and San Francisco.

Analysts agree that the war will take its toll on United, with TD Cowen’s Helane Becker saying that they’re anticipating the company to report at the low end of its forecast range.

The company is forecasting adjusted earnings between $1.50 and $1.80 a share for the current quarter compared to the $2.06 analysts are looking for. The forecast has been cut for the full year from $11-$12 a share to just $9.55-$9.85 a share.

UAL stock is down 19% in the past month and 32% over the last 3 months – begging the question, is now the time to cut losses? Or, should you weather the storm?

We’ve uncovered 3 things through the VectorVest stock analyzing software that you need to see before you make your next move.

Despite Excellent Upside Potential, UAL Has Poor Safety and Very Poor Timing

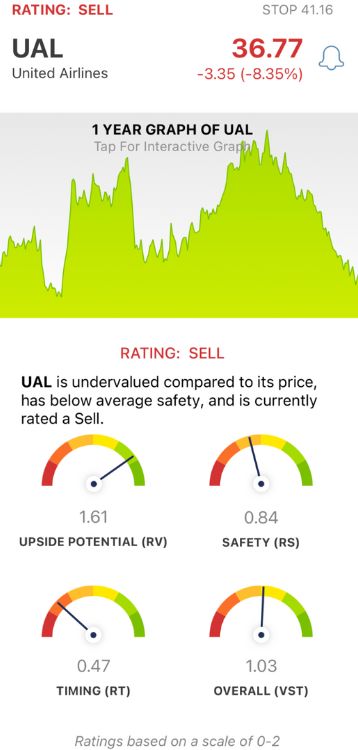

The VectorVest system tells you what to buy, when to buy it, and when to sell it based on a proprietary stock-rating system. You’re given all the insights you need to make clear, calculated, confident decisions in just 3 simple ratings.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00, with 1.00 being the average. Based on the overall VST rating for a given stock, you’re presented with a buy, sell, or hold recommendation to eliminate all guesswork and emotion from your trading strategy. As for UAL…

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential to AAA corporate bond rates and risk. And, after losing more than 30% of its value over the past few months, UAL now sits at a steep discount. The RV rating of 1.61 is excellent. And, the stock is undervalued with a current value of $73.05/share.

- Poor Safety: The RS rating is an indicator of risk derived through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. The RS rating of 0.84 is poor for UAL.

- Very Poor Timing: The biggest issue for UAL right now is the strong negative price trend that’s gripped the stock the past few months - and this will likely only get worse in the road ahead with today’s news. The RT rating of 0.47 is very poor. It’s based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.03 is just above the average and deemed fair. That being said, VectorVest has placed a SELL rating on this stock for the time being. Learn more through a free stock analysis today and make your next move with complete confidence and clarity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. UAL dropped 8%+ after issuing a grave warning regarding profits as a result of the Israel-Hamas conflict. The stock does have excellent upside potential, but poor safety and very poor timing holding it back. As such, VectorVest rates it a SELL.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment