Wayfair (W) investors got a nice surprise Friday morning as Bernstein changed its viewpoint on the company from Underperform to Market Perform. This adjustment came from analyst Nikhil Devnani who raised the price target for W from $60/share to $65/share.

Wayfair has been on a run over the long term, up nearly 48% in the past year. The stock has climbed more than 8% in the last 3 months alone.

Much of this has been driven by impressive revenue growth and margin commentary on recent earnings calls. Devnani says even beyond the strong run so far year-to-date, the company has strong upside potential in the coming quarters with more room for positive EBITDA revisions.

Bernstein isn’t the only group to see an upside in this stock either. In fact, 29 of the previous 30 earnings revisions from analysts have been positive. We won’t have an earnings update from the company for a few months.

That being said, the asset management company still maintains a modest outlook on the long-term targets Wayfair has. High competition and margin pressures are keeping Bernstein from going full bull outlook on the stock.

While this news sent shares of W a modest 2% higher in Friday’s trading session, it’s been headed downward for the past few weeks. The stock has fallen 12% in the last month. So, where does this leave investors or prospective traders?

We’ve taken a look through the VectorVest stock forecasting software to find out if the system aligns with Bernstein’s viewpoint. Take a look below to tune out the noise and get a clear answer on what you should do with this stock.

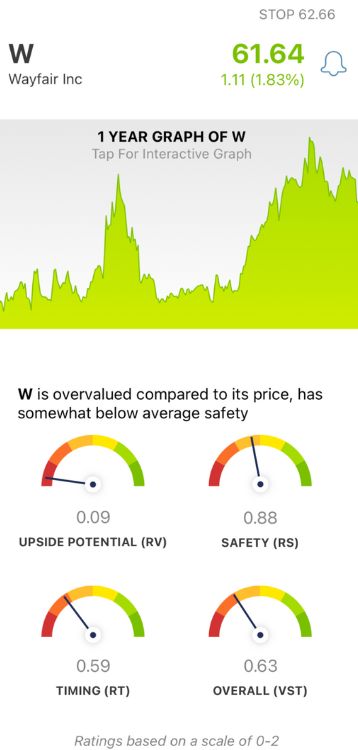

VectorVest Sees Very Poor Upside Potential and Poor Timing for W, But the Stock Does Have Fair Safety

The VectorVest system has outperformed the S&P 500 by 10x over the past two decades and counting. It’s done this while empowering traders to simplify their strategies and save time in front of their screens. How? Through a proprietary stock-rating system.

You’re given clear, actionable insights in just 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00 with 1.00 being the average for quick and easy interpretation.

But, it gets even easier because based on the overall VST rating for a given stock, the system issues a clear buy, sell, or hold recommendation at any given time. As for W, here’s what the system has to say:

- Very Poor Upside Potential: The RV rating draws a comparison between a stock’s long-term price appreciation potential (forecasted 3 years out) and AAA corporate bond rates & risk. The RV rating of 0.09 is about as poor as it gets for W. The stock is also overvalued with a current value of just $6.14

- Fair Safety: That being said, W is a fairly safe stock - although the RS rating of 0.88 is a bit below the average. This rating offers insights into a stock’s risk profile. It’s derived through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: As we mentioned earlier, the stock has been headed in the wrong direction for some time now. The poor RT rating of 0.59 is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.63 is poor - so does that mean it’s actually time to sell this stock? Where does this leave investors or prospective traders?

Get a clear answer on your next move through a free stock analysis at VectorVest today. You’re not going to want to miss this one if you’re interested in trading W!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Even though Bernstein upgraded W to market perform from underperform, the stock still has very poor upside potential and poor timing. While the stock does have fair safety, the RS rating is below average.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment