Raytheon Tech (RTX) is down more than 15% so far in Tuesday morning’s trading session. If this trend holds, it will be the biggest selloff for this stock since 9/11. So, what happened?

The US defense contractor and industrial corporation is facing concerns with certain airplanes it produced. The company has released a statement that select Pratt & Whitney engines will need to be removed from service for thorough inspection.

The issue can be tied to a powder metal used in the manufacturing process of crucial engine parts. A rare condition was discovered in this powder metal that compromises the life of the engines, so they’ll need to be inspected far earlier than they otherwise would.

Where things get really concerning is the scale of the issue. Chris Calio, the COO of Raytheon, says that any engines from the 4th quarter of 2015 into the 3rd quarter of 2021 could be at risk. This will require a minimum of 200 engines pulled from service, but it’s been assumed that more than 1,000 other engines will need to be inspected in the near term as well.

The issue itself was first discovered in 2020 and raised more serious questions about the company’s engineering processes themselves – which analysts pointed out on a recent earnings call. But, Calio held strong in his sentiment that all is going to be ok. He says that problems arise every day, and although this is a particularly expensive problem, it will be handled.

Making matters worse for Raytheon, this news overshadows what would have been a solid earnings report for the second quarter. The company grew sales to $18.315 billion from $16.314 billion the year prior, which was well above analysts’ consensus. Meanwhile, net income was up too – $1.327 billion, or 90 cents/share, which was a narrow improvement from last year at $1.304 billion, or 88 cents/share.

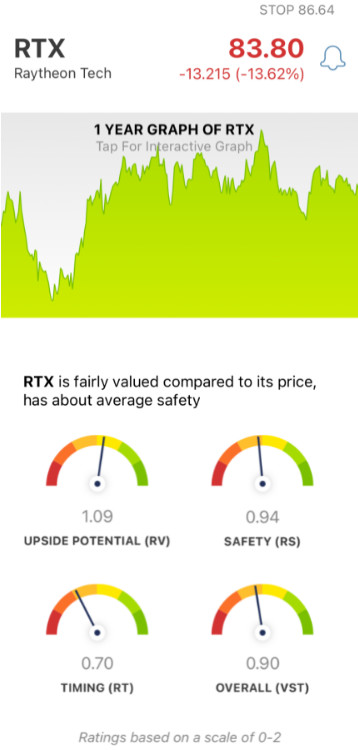

While some analysts still hold a buy rating on RTX stock, we’re not so sure. We’ve taken a look at the company through the VectorVest stock forecasting software and uncovered three things you’re going to want to see if you’re invested in this stock or are considering trading it.

While RTX Still Has Fair Upside Potential and Safety, the Stock Has Poor Timing After This Debacle

The VectorVest system helps you simplify your trading strategy by giving you all the insights you need for calculated, emotionless trading in just 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each of these sits on its own scale of 0.00-2.00, with 1.00 being the average. But to make things even easier, VectorVest issues a clear buy, sell, or hold recommendation for any given stock, at any given time, based on these ratings. That being said, here’s what we found for RTX:

- Fair Upside Potential: The RV rating is a comparison between a stock’s long-term price appreciation potential (forecasted three years out) and AAA corporate bond rates & risk. As for RTX, the RV rating of 1.09 is considered fair. Further to that point, the stock is fairly valued at its current price.

- Fair Safety: From a risk perspective, RTX is a fairly safe stock - with an RS rating just below the average at 0.94. This rating is derived through a detailed analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: The one thing holding this stock back right now is the bad news that sent shares in a downward spiral. Right now, the stock has a poor RT rating of 0.70 - which is a rating based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.90 is fair for RTX - but is it enough to justify holding on through this tumultuous period? Or, should you sell off your shares now and buy back in later on when things are looking better for the company?

Don’t play the guessing game or let emotion cloud your judgment. Get a clear buy, sell, or hold recommendation for RTX through a free stock analysis at VectorVest today.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. While RTX earnings were fairly solid, bad news over engine problems stole the spotlight and sent the stock price towards its worst performance since 9/11. Despite fair upside potential and safety, the stock does have poor timing right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment