Early this morning, Shutterstock (SSTK) released an update on its partnership with OpenAI. The contract has been expanded to 6 years and with a renewed scope.

The two companies have been working together since 2021. But just last fall in October, Shutterstock made official the news that it planned to offer AI-generated images to its customers – powered through OpenAI’s software. And, customers are even able to edit any image in the Shutterstock library using OpenAI’s synthetic editing capabilities.

And now, under the terms of today’s deal, Shutterstock is throwing a bone back to OpenAI. The company will help train OpenAI’s machine learning software by providing photo, video, and music assets. This means that AI image generation is only going to get better and better as the training progresses.

As is the case with most companies diving into AI, the response has been positive. Shares were up 11% early this morning and have settled around 8%. And, experts believe this trend is going to continue. Many analysts are projecting an average upside of 63% for this stock over the next 12 months.

That being said, this couldn’t have come at a better time for SSTK investors – who have suffered through a 26% fall-off over the last 3 months. So, is it time to buy SSTK? Or, should you wait to see how the trend that’s formed today holds?

Below, we’ve analyzed SSTK through the VectorVest stock forecasting software. We have 3 things we want to share with you to help you make your next move with complete confidence and clarity.

SSTK Has Very Good Upside Potential and Fair Timing, But the Stock’s Safety is Poor

The VectorVest system simplifies your trading strategy by giving you clear, actionable insights in just 3 simple ratings - saving you time, stress, and human error. It’s all based on a proprietary stock rating system that has outperformed the S&P 500 by 10x for the past two decades and counting while calling every major market move along the way.

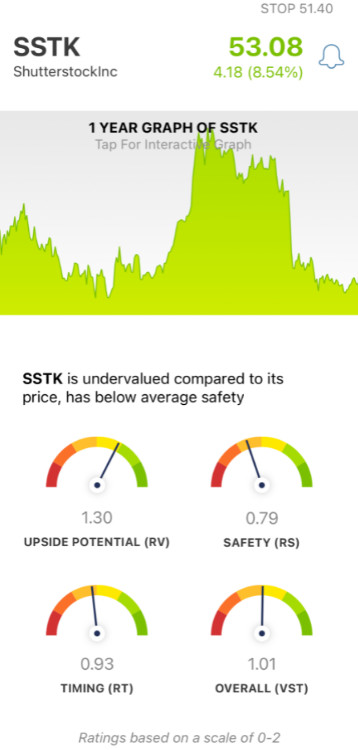

The ratings are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00, with 1.00 being the average. This allows for quick and easy interpretation.

But it gets even better. Because based on the overall VST rating for a given stock, the system offers a clear buy, sell, or hold recommendation - at any given time. As for SSTK, here’s what we’ve unearthed:

- Very Good Upside Potential: The RV rating draws a comparison between a stock’s long-term price appreciation potential (3 years out) and AAA corporate bond rates & risk. And right now, the RV rating of 1.30 is very good. What’s more, the stock is undervalued - with a current value of $75/share.

- Poor Safety: The biggest issue for SSTK is risk. The stock has a poor RS rating of 0.79, which is calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Fair Timing: While the price trend for this stock was negative coming into today, there has been a reversal - the only question is, will it hold? Right now, the RT rating of 0.93 is slightly below the average but deemed fair nonetheless. This is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.01 is just above the average and is considered to be fair. But is it enough to earn the stock a buy recommendation? Or, should you hold off on making a move one way or the other to see what happens in the coming days/weeks?

Don’t play the guessing game or let emotional investing get in the way of profits. Get a clear recommendation on your next move based on a tried and true trading system at VectorVest - a free stock analysis is just a click away!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. While SSTK has poor safety, the stock is currently undervalued and has very good upside potential. And although the timing is just fair today, it will be interesting to see how today’s news affects the stock’s price trend in the big picture.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment