Much to the delight of shareholders, Shell (SHEL) announced today that dividends paid out will be increasing going forward. The company was already distributing 20%-30% of cash flow from operations but is boosting that figure up to 30%-40%.

This will entail raising the dividend per share for the second quarter by at least 15%. Meanwhile, the company expects to invest at least $5b in share buybacks before the end of the year. Safe to say Shell has no shortage of cash on hand to invest back into the company.

The company has been on a mission to simplify things internally for a while now – along with elevating investor confidence. CEO Wael Sawan says that the business’ guiding principles going forward are performance, discipline, and simplification. As a result, the company is investing in models that work and offer the highest returns.

While the focus is on operational efficiency and profits, there is a balancing act going on behind the scenes. Shell has made a goal to become a net-zero business before 2050, and they’re currently on pace.

With that said, the company is reported to be in danger of breaching the 2015 Paris Agreement – which calls for a halving of carbon emissions in the next 6 and a half years (before 2030). While Shell is focused on growing that side of the business, critics claim they should be doing the opposite.

So, while things are clearly going well for Shell right now, the future is uncertain – not just for the company itself, but the climate. That being said, the stock is up nearly 14% in the last 3 months. It’s up another 2% today alone. So, should you take this opportunity to buy SHEL and capture a piece of that dividend? Or, is there reason to stay away from this stock?

We’ve taken a look through the VectorVest stock analyzing software and want to share 3 things that will help you make your decision confidently.

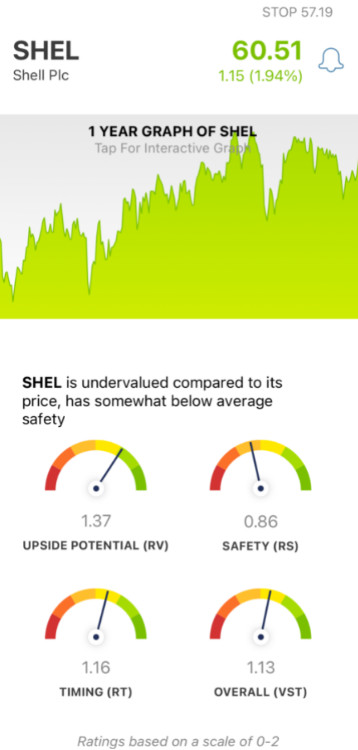

SHEL Has Fair Safety, Good Timing, and Very Good Upside Potential

The VectorVest system helps you simplify your trading strategy by providing you with all the insights you need to make clear, calculated decisions in 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00, with 1.00 being the average. This allows for quick and easy interpretation. Or, better yet, follow the clear buy, sell, or hold recommendation VectorVest offers based on these ratings. As for SHEL, here’s what we found:

- Very Good Upside Potential: The RV rating is a comparison between a stock’s long-term price appreciation potential (projected 3 years out), AAA corporate bond rates, and risk. And right now, the RV rating of 1.37 is very good. What’s more, the stock is undervalued - with a current value of $81/share.

- Fair Safety: While the RS rating of 0.86 is a ways below the average, it’s still deemed fair. This rating is derived through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Good Timing: To tie it all together, SHEL has good timing - with an RT rating of 1.16. This rating speaks to the price trend of the stock, and is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.13 is good - but is it enough to justify buying SHEL? Don’t play the guessing game or make an emotional decision. Get a clear answer based on a tried and true approach to stock analysis at VectorVest today. Your free stock analysis is just a click away!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for SHEL, the company has fair safety, good timing, and very good upside potential. Plus, shareholders are enjoying consistent, rising dividend payouts.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment