Alibaba (BABA) reported earnings for the first time since the company split into six separate units – and the first time since China’s full reopening. While this report was highly anticipated by shareholders and prospective investors alike, it fell short of expectations.

The company grew revenue by a modest 2% year over year to 208.2 billion Chinese yuan. But, this figure still came in well under the analyst expectations of 210.2 billion yuan. Non-GAAP diluted earnings per share was a disappointment as well, at 1.34 yuan vs. 2.08 yuan expected. Still, this was a 35% improvement year over year.

Much of this underperformance can be attributed to a slow start to the quarter in China’s retail market. Sales began to pick up in April, but it was too little too late. Nevertheless, this recent uptick in consumer demand will bode well for the current quarter and the remainder of the year.

And there is more good news – the company’s cloud division is going to become its own publicly traded company. One analyst chimed in to say that this was going to have a positive impact on the valuation of Alibaba. The goal is for this new company to compete with the likes of Amazon and Microsoft – lofty aspirations, no doubt.

Along with this news, Alibaba announced its intention to raise funds for its international digital commerce group. These are the platforms most think of when Alibaba is mentioned – being AliExpress and Lazada. This capital will be raised through outside investors.

The company also announced an upcoming IPO for one of the new 6 units the business has been split into: its Cainiao Smart Logistics unit. This launch is scheduled sometime in the next 12-18 months.

The market’s reaction to all this news was negative, which should come as no surprise. This is something shareholders have been waiting for patiently, and the company failed to deliver. As a result, BABA is down more than 5% in Thursday’s trading session.

But, is this indicative of what’s to come in the near term for this stock? After all, it was up more than 6% leading into this news. We’ve put BABA under a microscope through the VectorVest stock analyzing software. And, we found 3 things you’re going to want to see if you’re currently holding BABA stock or are considering adding it to your portfolio…

Despite Being a Fairly Safe Stock, BABA Has Poor Upside Potential and Timing

The VectorVest system gives you clear, actionable insights through three simple ratings - helping you win more trades with less time and effort.

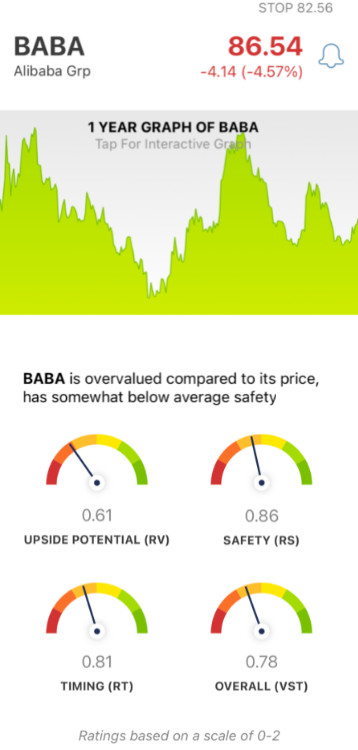

These are relative value (RV), relative safety (RS), and relative timing (RT). Each rating sits on a scale of 0.00-2.00, with 1.00 being the average - allowing for effortless interpretation.

But it gets even easier for investors who use the system - because based on the overall rating for a given stock, you’re given a clear buy, sell, or hold recommendation. As for BABA, here’s what you need to know before you make your next move:

- Poor Upside Potential: The RV rating compares a stock’s 3-year price appreciation potential alongside AAA corporate bond rates and risk. And right now the RV rating of 0.61 is considered poor. Plus, the stock is deemed overvalued as it stands today. Its current value is a mere $47.

- Fair Safety: In terms of risk, though, BABA is a fairly safe stock. While the RS rating of 0.86 is a ways below the average, it’s considered fair nonetheless. This is derived through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: One of the biggest issues holding BABA back is timing - with a poor RT rating of 0.81. This is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

All things considered, the overall VST rating of 0.78 is poor. What does that mean for you as a current shareholder or potential investor? Does VectorVest consider it time to sell BABA - or, should you hold on a bit longer before making a decision one way or the other?

No need to let emotion cloud your judgment or play the guessing game in your investment strategy. Get a clear answer through a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. After the earnings miss today, it’s clear that BABA has poor timing - but it also has poor upside potential holding it back. While the safety of this stock is fair, you’ll want to get a free stock analysis to help you make your next move in confidence.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment