Famed investor Michael Burry recently unveiled 7 stocks he’s added to the Scion Asset Management portfolio. As all signs point to an economic downturn on the horizon, Burry still believes these stocks have the opportunity for growth. And in this series, we’re going to examine them through the lens of VectorVest to determine if any of these stocks belong in your portfolio as well.

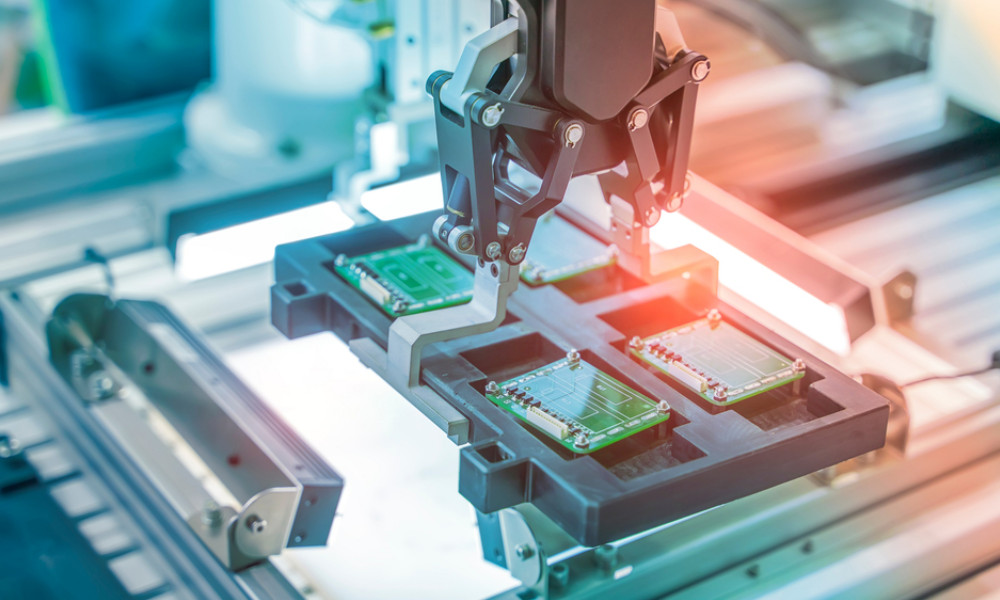

Today, we’re going to analyze Coherent (COHR), a company that specializes in the manufacturing of optical materials and semiconductors. Burry purchased 150,000 shares of COHR in his latest move, which makes up nearly 11% of Scion’s total portfolio. Obviously, he sees potential in this stock – but what exactly made this company pop up on his radar?

Well, last time the company delivered earnings they saw a 70% growth in revenue year over year – meeting the street’s expectations and beating the company’s own record. They reported a backlog of $2.9 billion as well while beating out analyst expectations for EPS at $0.95/share.

In the last three months, COHR has grown 17% on the stock market – but this trend appears to have subsided in the more short-term viewpoint. The stock is actually down 6% in the last month.

Nevertheless, we want to examine COHR through the VectorVest stock analyzing software to get a better understanding of what opportunities exist here for you as an investor. This will allow you to get a clear buy, sell, or hold recommendation for this stock as it stands today:

COHR Has Fair Upside Potential, Safety, and Timing

The VectorVest system helps you uncover opportunities on autopilot so you can win more trades with less work. It simplifies your trading strategy by giving you all the insights you need in just three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Together, these sit on a scale of 0.00-2.00, with 1.00 being the average. Ratings over the average indicate overperformance in a given category and vice versa. But the best part is that VectorVest compiles these three ratings into an overall rating for the stock. And based on that you’re given a clear buy, sell, or hold recommendation. So - let’s take a look at what the system currently has to say about COHR:

- Fair Upside Potential: The RV rating gives you a better understanding of the true long-term price appreciation for a stock compared to AAA corporate bond rates and risk. And right now, the RV rating of 1.01 is just above the average. Taking this analysis a step further, the stock is fully valued at its current price point of $41/share.

- Fair Safety: In terms of risk, COHR is a fairly safe stock. The RS rating of 0.97 is just below the average. This rating is calculated based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Fair Timing: Looking at the price trend for this stock day over day, week over week, quarter over quarter, and year over year, the timing is just fair - with an RT rating of 0.98. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement.

Now - these three ratings contribute to an overall VST rating of 0.98 - which is fair. But is it enough to earn the stock a buy? Or should you wait a bit longer for a stronger price trend to form and push the stock’s price in the right direction? Don’t play the guessing game or let emotion influence your decision-making. Get a clear answer on your next move with a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Right now, COHR has fair upside potential, safety, and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment