No Guessing Games.

You Deserve Clear Answers.

If you want to make money in the market, you need smarter information.

The kind of information that gives you answers on the stocks you care about, 24-7.

Answers to critical questions like…

What is this stock really worth?

How safe is it?

Should I buy, sell or hold?

Well, there’s no faster, easier way to get those answers than VectorVest.

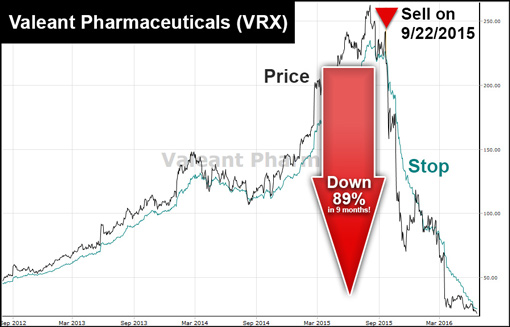

Take a look at Valeant Pharmaceuticals (VRX).

On August 21, investors were still piling into VRX at $221.19 a share.

Why was that so crazy?

Because by June 26, 2015 VectorVest’s short-term and intermediate-term market timing signals were down…

And on July 2, 2015 VectorVest issued a “Confirmed Market Down” signal, it’s most conservative timing signal, publishing …“It’s time to be defensive and protect profits.” And that’s not all…

By August 20, 2015 VectorVest’s momentum indicator, Relative Timing (RT), for VRX became unfavorable, crossing

below 1.00 at 0.89.

All before Valeant took an 89% nosedive, costing investors millions.

You might think this kind of information is a one-hit wonder, but incredibly, VectorVest has been blowing the whistle on bad stocks (and saving unsuspecting investors) for 28 years.

It has literally helped hundreds of thousands of everyday investors get

steady, predictable growth year-after-year…through the Global Financial Crisis… through the Flash Crash… through the good times and especially the BAD.

How? By...

- Taking the emotion out of investing.

-

Making the answers so easy to understand that anyone from a pro to a beginner can be a more successful investor.

- Creating a system that simply works (even if you’re too busy to spend hours managing your portfolio).

VectorVest’s indicators use behind-the-scenes algorithms to do all the work—Work that would be impossible for you (or even an entire TEAM of analysts) to do alone.

These indicators objectively rate and rank the value, safety and

timing of every stock for you. And give a clear Buy, Sell or Hold recommendation to every stock every day—no guessing, no wasting hours of your time chasing answers.

Here’s a simple formula for making money in the market:

Easy answers + Accurate information = Smarter investing decisions

And you know what smarter investing decisions lead to? Better

profits.

Want more proof that VectorVest will work for you?

- VectorVest gave a Sell rating to drug giant, Valeant Pharmaceuticals (VRX) on 9/22/15 @ $216.76, now trading for less than $30, saving investors from an 86% loss.

- Fitbit (FIT) may be the most popular health gadget around, but VectorVest still gave it a sell at $39.37 on 8/21/15—it skidded to a stop at $11.91 on 2/24/16.

You would have preserved 69.7% of your hard-earned capital.

- Even good stocks can fall on hard times.

VectorVest’s rating warned investors it was time to take profits on Community Health (CYH) when it moved to a Sell on 8/24/15 at $53.44, as of May 2016 it’s traded as low as $11.81.

Investors were thrilled at keeping 77.9% safe and sound!

- VectorVest saved thousands of investors from a taking a giant-size loss on H&R Block (HRB) when they were rated a ‘Sell’ at $32.66.

The share price dropped from $37.40 on November 2, 2015 to a painful $19.52 as of May 12, 2016.

That cut a 47% loss to 12%!

Through the decades, there have been thousands of real-life VectorVest “saves.”

We even encourage investors to look up their biggest losers and see for themselves what VectorVest had to say!

What’s the secret?

The right information at the right time.

What more can you ask for?

Now, there’s nothing holding you back!

Remember, Before you invest, Check VectorVest!

Analyze your stocks today!