For the first time since the Arab Oil Embargo of October 1973, America appears to have a viable path to energy independence. In a CIT 2012 Outlook Survey of over 100 energy company executives, a majority see American energy independence achievable within 15 years, with nearly half citing natural gas as the most crucial fuel. For the first time since the Arab Oil Embargo of October 1973, America appears to have a viable path to energy independence. In a CIT 2012 Outlook Survey of over 100 energy company executives, a majority see American energy independence achievable within 15 years, with nearly half citing natural gas as the most crucial fuel.

Natural gas? Yes, natural gas. America has tremendous quantities of natural gas in underground deposits all across the country, and it now has the technology to get it at competitive prices. This technology is called "hydraulic fracking" and it has taken the country by storm.

What is Hydraulic Fracking?

Hydraulic fracking is a process in which fluids, primarily water and sand, are injected under high pressure into a shale or rock formation containing gas and/or oil, creating fissures that allow the gas and/or oil to move freely from the pores of the formation where it was trapped. Although the energy industry knew that huge gas resources were trapped in shale rock formations in the United States, it is only over the past decade that drillers have combined two established technologies, hydraulic fracking and horizontal drilling, to successfully unlock this resource. Hydraulic fracking has become the fastest growing source of gas in the United States and has produced numerous millionaires. Fortunately, it's not too late to join the party, but where does one start?

Let's go right to the horse's mouth. I Googled "Investing in Shale Gas Stocks" and got 1,710,000 results in 0.24 seconds. The CIT 2012 Outlook Survey mentioned above appeared on the top of my screen. To the right of the screen it was a Market Vectors Unconventional Oil & Gas ETF with the ticker symbol FRAK. It is a new ETF and will be available for viewing in VectorVest 7 on Monday. There are 20 stocks, 16 U.S. and 4 CDN, listed in this ETF, so we created a new WatchList called "Shale Oil & Gas Companies" and put it into the Overview WatchList Folder. We will add additional shale gas companies as we become aware of them. We decided to create a second WatchList called "Shale Oil & Gas Players" for all the other companies doing business in this area.

Nobody Analyzes Energy Stocks Like VectorVest

Try VectorVest Risk FREE for as little as $9.95

How to Invest in the Shale Gas Boom

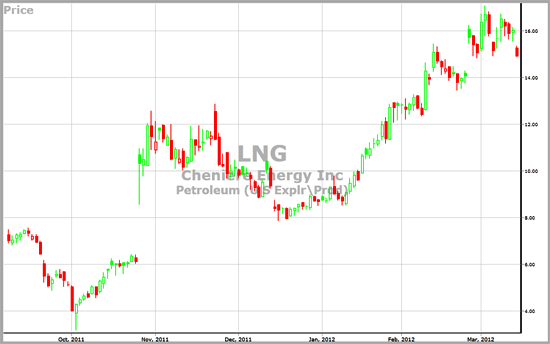

Cheniere Energy, LNG

For example, a Google search result headlined, "How to Invest in the Shale Gas Boom," identified Cheniere Energy, LNG, as a unique shale gas play because it was modifying its facilities to be able to export liquefied natural gas, LNG, as well as import LNG as it was originally intended to do. You may recall that I cited Cheniere Energy, LNG, as a stock of interest in my essay of September 9, 2011. It closed that day at $7.01 per share, fell to a low of $4.00 on 10/03/11 and now is trading at $16.67.

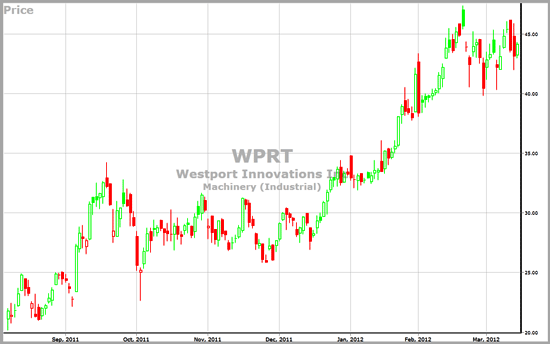

Westport Innovations, WPRT

Another spectacular performer is Westport Innovations, WPRT. This company makes engines that run on gaseous fuels, including natural gas. Its business is beginning to boom. It was trading at around $20 last August, now it's at $43.27. A major obstacle in the use of natural gas for transportation purposes is the lack of fueling stations along the highways.

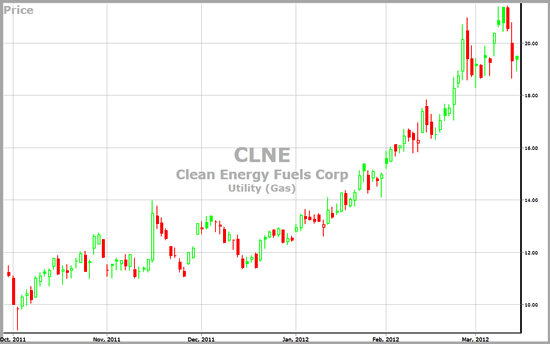

Clean Energy Fuels Corp., CLNE

However, Clean Energy Fuels Corp., CLNE, is addressing that problem. It designs, builds, finances and operates fueling stations and supplies the customers with compressed natural gas (CNG) and liquefied natural gas (LNG). It hit a low of $9 and change on October 4, 2011 and now is trading at $18.69.

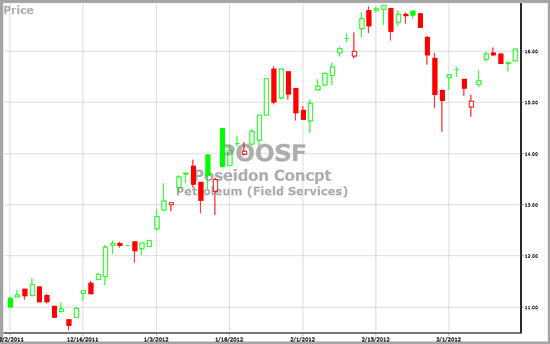

Poseidon Concepts, POOSF

Another interesting stock is Poseidon Concepts, POOSF. It is a fluid management company which provides services and develops frac tanks which are used for containment of "Water" and "Oil" frac fluids. A fracking well can use as much as 5,000,000 gallons of water over its lifetime and environmentalists are all over the fracking drillers. So there's a strong demand for POOSF's services. The stock was trading at around $10 - $11 a share in mid-December and shot up to $16.89 a few weeks ago. Now it's trading at $15.63.

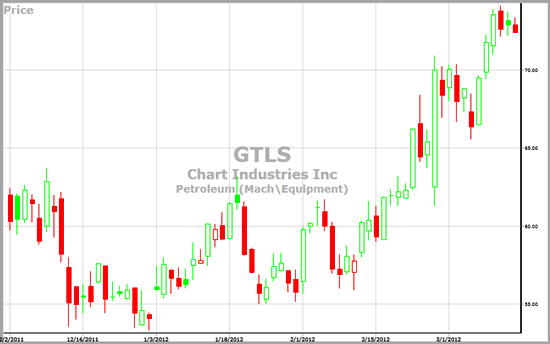

Chart Industries Inc., GTLS

I must warn you that none of these stocks are making money at this time, so the best way to play them is to wait until they get beat down in price before you buy them. Just to let you know, some companies associated with the natural gas business do make money. Take a look at Chart Industries, GTLS. This company specializes in the manufacture and servicing of cryogenic equipment which is critical to the production and distribution of liquefied natural gas. Even though its Price is above its current Value, it has a solid RV of 1.28 and a GRT of 33% per year. I own it.

American Energy Independence

The successful extraction of oil and gas from shale and rock formations is changing America for the better dear readers, and I'm very happy to see it happen. In the meantime, do your homework, pick some winners and make money as we move toward American Energy Independence.

Nobody Analyzes Energy Stocks Like VectorVest

Try VectorVest Risk FREE for as little as $9.95

P.S. An excellent site to visit is www.energyfromshale.org. It provides a great overview of the shale gas business. An article entitled, "Four Natural Gas Companies Investors Can Buy Right Now," caught my eye and is worth reading. The companies are EOG Resources, EOG, Chesapeake Energy, CHK, Devon Energy, DVN, and Anadarko Petroleum, APC. While reading this article, I got sidetracked and clicked on an article called, "Occidental Petroleum Corp., OXY, The Best Way to Profit from the Monterey Shale." I like OXY a lot and found this article to be extremely interesting. |