|

One of the hottest topics in the investment community is whether or not AAPL is too high...and everyone seems to have an opinion. Everyone but VectorVest. VectorVest doesn't provide opinions; VectorVest simply provides the answers that savvy investors need to make faster, smarter, better trading decisions, including what a stock is really worth.

VectorVest doesn't provide opinions; VectorVest provides answers.

There's no denying that earnings are the most powerful force in the market. Think of them as the engine that drives a stock's price higher. If something goes wrong with earnings then the engine stalls and the stock price stagnates, this may even cause the stock price to crash. Since changes in interest rates, as well as inflation rates, heavily influence the direction of earnings, the most accurate way to determine a stock's value is to incorporate the stock price, earnings per share, interest rates and inflation. If this sounds complicated, it is. That's why VectorVest does the calculation for you, every day, for over 23,000 stocks worldwide -- including AAPL.

Nobody Analyzes Stocks Like VectorVest

Try VectorVest Risk-FREE for as little as $9.95

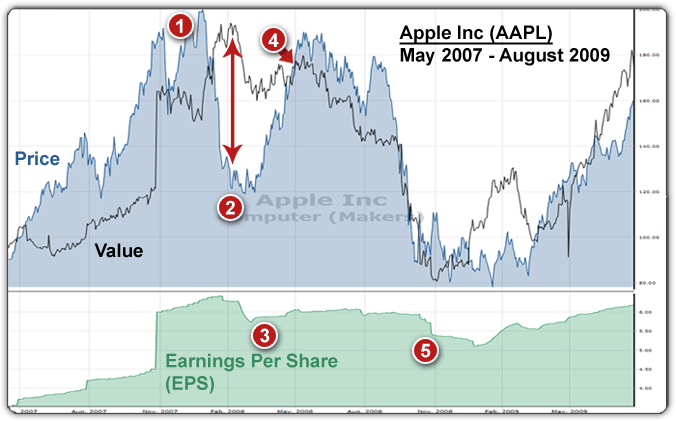

The price of Apple and VectorVest’s Value climbed together until the Bear Market of 2008 when earnings began to fall.

VectorVest Analysis of AAPL

Value: Value is a measure of a stock's current worth. AAPL has a current Value of $858.55 per share. Therefore, it is undervalued compared to its Price of $602.50 per share. Value is computed from forecasted earnings per share, forecasted earnings growth, profitability, interest, and inflation rates. Value increases when earnings, earnings growth rate and profitability increase, and when interest and inflation rates decrease. At some point in time, a stock's Price and Value always will converge.

RV (Relative Value): RV is an indicator of long-term price appreciation potential. AAPL has an RV of 1.64, which is excellent on a scale of 0.00 to 2.00. This indicator is computed from an analysis of projected price appreciation three years out, AAA Corporate Bond Rates, and risk.

RS (Relative Safety): RS is an indicator of risk. AAPL has an RS rating of 1.49, which is excellent on a scale of 0.00 to 2.00. A stock with an RS rating greater than 1.00 is safer and more predictable than the average stock.

RT (Relative Timing): RT is a fast, smart, accurate indicator of a stock's price trend. AAPL has a Relative Timing rating of 1.5, which is excellent on a scale of 0.00 to 2.00.

VST (VST-Vector): VST is the master indicator for ranking every stock in the VectorVest database. AAPL has a VST rating of 1.54, which is excellent on a scale of 0.00 to 2.00. Stocks with the highest VST ratings have the best combinations of Value, Safety and Timing. These are the stocks to own for above average, long-term capital appreciation.

Recommendation (REC):AAPL has a Buy recommendation. REC reflects the cumulative effect of all the VectorVest parameters working together. These parameters are designed to help investors buy safe, undervalued stocks rising in price. They also help investors avoid or sell risky, overvalued stocks falling in price.

Stop (Stop-Price): Stop is an indicator of when to sell a long position or cover a short position. AAPL has a Stop of $499.59 per share. A stock's Stop is computed from a 13 week moving average of its closing prices, and is fine-tuned according to the stock's fundamentals.

|

Investors correctly anticipated the effect of the bear market on Apple's earnings but over-reacted.

The Bear Market of 2008-2009 saw the onset of a panicked sell-off that even impacted retail giants like Apple. Notice on the chart above, the divergence of price and value that occurred in February of 2008. AAPL's price corrected sharply moving from a peak of nearly $200.00 (1) a share to $119.15 a share (2), a 66% drop in price. What happened? Investors correctly anticipated the negative effect of the bear market on Apple's earnings (3) but over-reacted. The VectorVest Value however, was not subject to this emotional reaction and remained much higher, stabilizing at $160.

After this severe separation of price and value, price rebounded and once again returned to meet the VectorVest Value at approximately $168.00 a share on April 25, 2008 (4). Unfortunately the bear market continued and both price and value were driven down together as earnings continued to weaken (5).

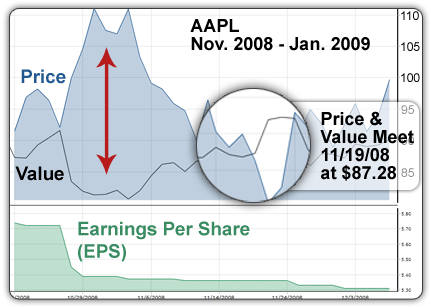

Price and Value meet at $87.28 per share November 19, 2008 and again on November 24, 2008, resolving the previous divergence.

In November of 2008 (above), we once again saw the divergence of price and value. This time price rose to $111.04, despite value falling to $80.68 in response to weakening earnings. The extreme divergence corrected as price fell to meet value shortly after at $87.28 a share.

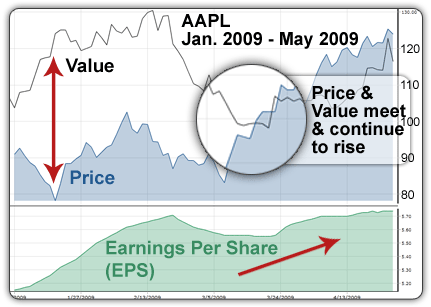

January of 2009 marked the end of the Bear Market, immediately detected by VectorVest Valuations.

January of 2009 marked the end of the Bear Market, but it wasn't necessarily recognized by investors. Earnings began to rise and were immediately detected by VectorVest Valuations, causing them to go up even as stocks were still falling. This caused another divergence to develop as AAPL's price bottomed at $78.20 on January 20, 2009 while the stock's value had risen to $124.14. Just two months later price and value would meet and continue to rise together.

Due to the rising trend of earnings, value is well above price and rising months before the AAPL started to recover.

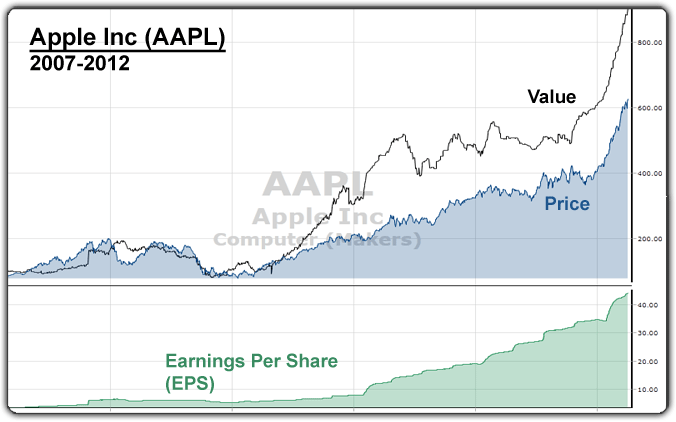

This incredibly volatile, unpredictable time period demonstrates how effective the VectorVest formula for valuation is. Despite the emotionally charged environment, AAPL's price and VectorVest's Value of AAPL continued to meet after every divergence, which brings us to the present day...

What is AAPL Really Worth?

AAPL's earnings have continued to increase since 2009. While interest rates are slowly beginning to rise, inflation is still falling and the combination has proved no match for earnings power of Apple's product line. As you can see by the chart, AAPL's latest high of $617.82 may not make it a 'cheap' stock to buy but it's still a bargain for its current worth of $885.52.

VectorVest provides all of this information and much more, every day for over 23,000 stocks worldwide. Our indicators have been tested and proven for more than 23 years by real investors just like you. Don't go another day without this vital information. Try VectorVest risk-free for 5-weeks for just $9.95

Nobody Analyzes Stocks Like VectorVest

Try VectorVest Risk FREE for as little as $9.95

|